Introduction

When it comes to protecting our homes and businesses, security systems play a vital role. They provide peace of mind by deterring potential threats and helping law enforcement respond more effectively in case of an incident. However, the cost of installing and maintaining security systems can be substantial. One common question that arises is whether security systems are tax-deductible. In this article, we will explore the tax implications of security systems, including residential, and business applications.

Residential Security Systems

Home Security Systems

Home Security Expenses

Installation Costs

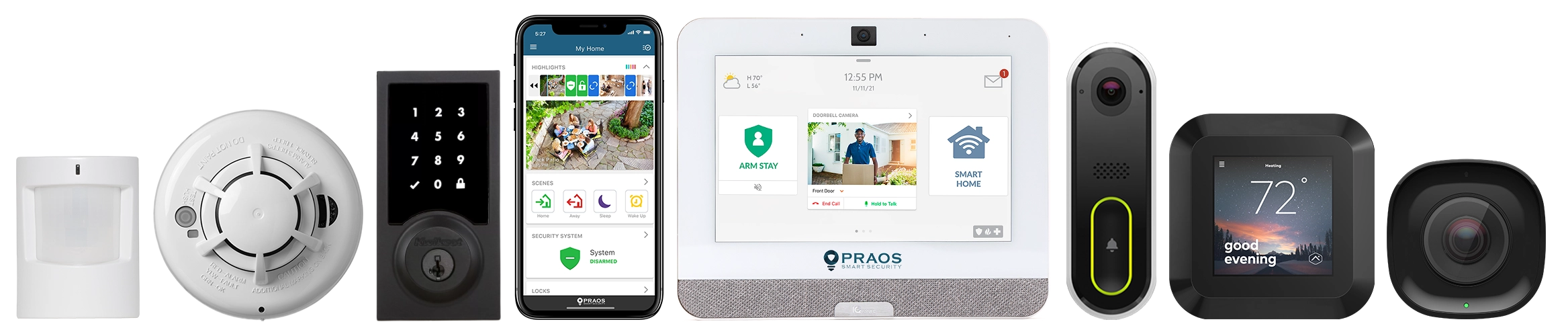

- Home security systems often include surveillance cameras, motion detectors, alarms, and monitoring services.

- The initial installation costs for these systems may not be tax-deductible for homeowners unless they are directly related to a home office or business use.

Home Office Deductions

- If you have a home office, you may be able to deduct a portion of your security system expenses.

- To qualify for this deduction, your home office must be used exclusively and regularly for business purposes.

Home Improvement Tax Credits

Energy Efficiency Upgrades

- Some security system components, such as smart thermostats and energy-efficient lighting, may qualify for energy-efficient home improvement tax credits.

- These credits are designed to promote energy conservation and can help offset the cost of certain security-related upgrades.

Home Insurance Premiums

- Installing a security system can often lead to reduced home insurance premiums.

- While not a direct tax deduction, the savings from lower insurance costs can offset some of the expenses associated with security systems.

Business Security Systems

Expense Deductions for Businesses

Installation and Maintenance

- Businesses can typically deduct the full cost of security system installation and ongoing maintenance as a business expense.

- This deduction can help lower a business’s taxable income.

Monitoring Services

- Expenses related to security monitoring services, such as monthly fees, can also be deducted as a business expense.

Small Business Tax Credits

Section 179 Deduction

- The Section 179 deduction allows small businesses to deduct the cost of certain qualifying business security equipment and improvements.

- This deduction is subject to specific annual limits and eligibility criteria.

Enhanced Security Measures

Qualified Improvements

- The Tax Cuts and Jobs Act (TCJA) of 2017 expanded the definition of qualified improvements, which includes certain security system enhancements.

- Businesses may be able to recover the costs of these improvements faster through depreciation deductions.

Conclusion

Praos Customer Service

While security systems may not be directly tax-deductible for homeowners in most cases, there are exceptions for home offices and energy-efficient upgrades. On the other hand, businesses can often deduct security system expenses as business-related costs, with potential benefits such as small business tax credits and accelerated depreciation. It’s important to consult with a tax professional or accountant to determine your specific eligibility for deductions and credits related to security systems. If you are looking to get a new home security system installed in Greater Richmond, contact Praos Solutions today!